New publication in Quantitative Finance Journal

About

At the end of October, the paper Numerical smoothing with hierarchical adaptive sparse grids and quasi-Monte Carlo methods for efficient option pricing by Christian Bayer (Weierstrass Institute for Applied Analysis and Stochastics - WIAS), Chiheb Ben Hammouda (RWTH Aachen University), and Raul Tempone (King Abdullah University of Science and Technology - KAUST; RWTH Aachen University), was published in the Quantitative Finance Journal and is available at Taylor & Francis Online.

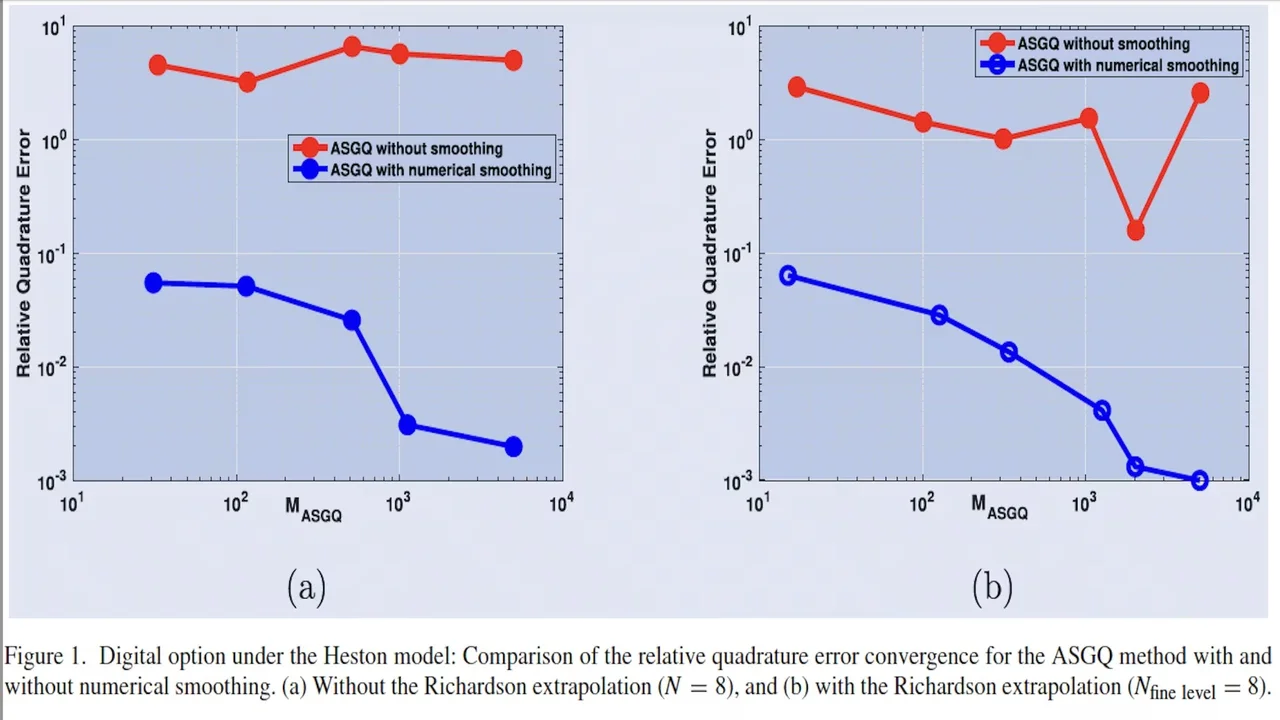

Abstract: When approximating the expectations of a functional of a solution to a stochastic differential equation, the numerical performance of deterministic quadrature methods, such as sparse grid quadrature and quasi-Monte Carlo (QMC) methods, may critically depend on the regularity of the integrand. To overcome this issue and improve the regularity structure of the problem, we consider cases in which analytic smoothing (bias-free mollification) cannot be performed and introduce a novel numerical smoothing approach by combining a root-finding method with a one-dimensional numerical integration with respect to a single well-chosen variable. We prove that, under appropriate conditions, the resulting function of the remaining variables is highly smooth, potentially affording the improved efficiency of adaptive sparse grid quadrature (ASGQ) and QMC methods, particularly when combined with hierarchical transformations (ie., the Brownian bridge and Richardson extrapolation on the weak error). This approach facilitates the effective treatment of high dimensionality. Our study is motivated by option pricing problems, focusing on dynamics where the discretization of the asset price is necessary. Based on our analysis and numerical experiments, we demonstrate the advantages of combining numerical smoothing with the ASGQ and QMC methods over these methods without smoothing and the Monte Carlo approach. Finally, our approach is generic and can be applied to solve a broad class of problems, particularly approximating distribution functions, computing financial Greeks, and estimating risk quantities.